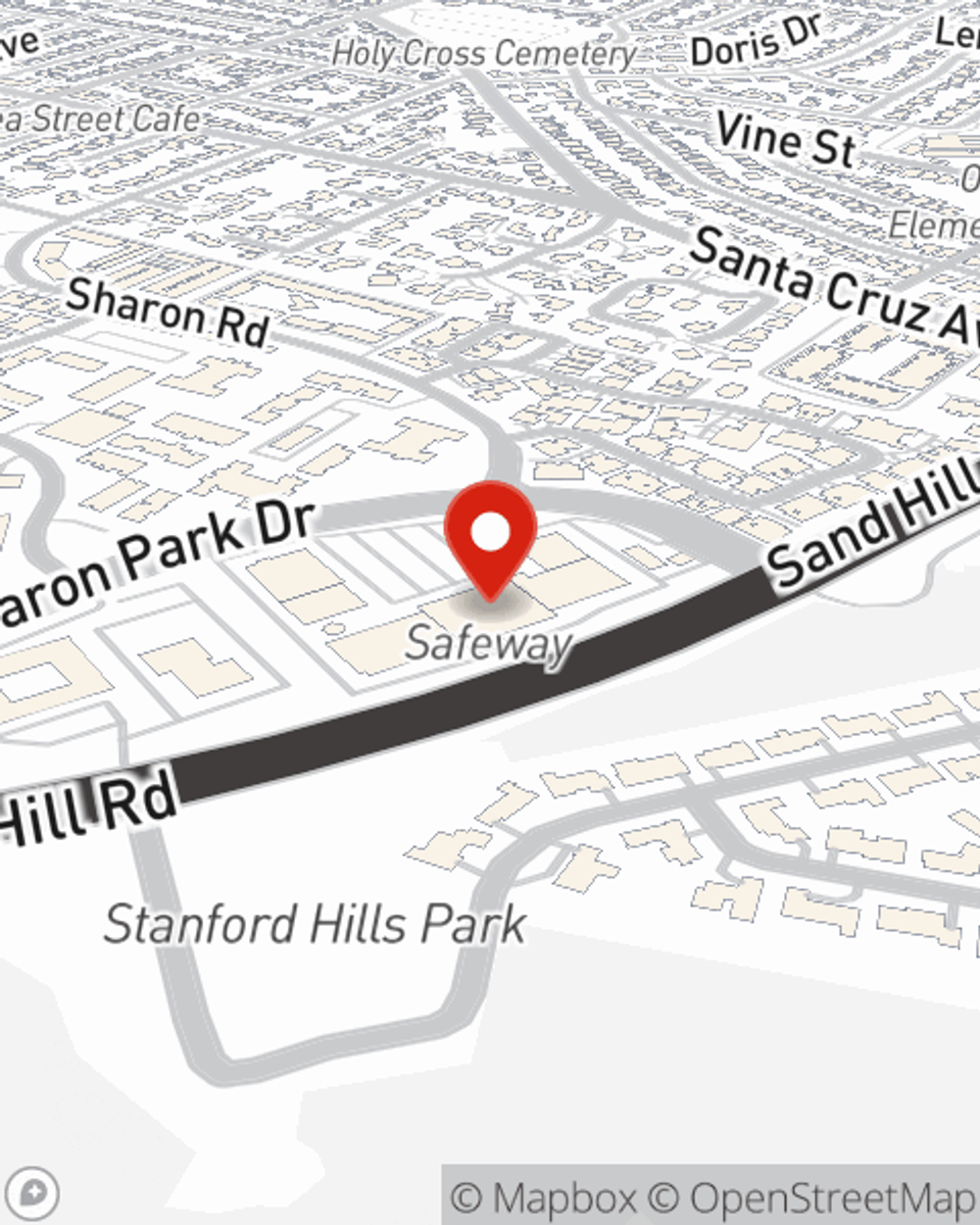

Business Insurance in and around Menlo Park

Calling all small business owners of Menlo Park!

This small business insurance is not risky

- Sharon Heights

- Menlo Park

- Atherton

- San Mateo County

- Woodside

- Portola Valley

- Palo Alto

- Los Altos

- Santa Clara County

- Stanford

- Los Altos Hills

- Palo Alto Hills

- La Honda

- Mountain View

- Redwood City

- Emerald Hills

- San Carlos

- San Mateo

- Milpitas

- Sunnyvale

Coverage With State Farm Can Help Your Small Business.

When experiencing the challenges of small business ownership, let State Farm do what they do well and help provide excellent insurance for your business. Your policy can include options such as business continuity plans, a surety or fidelity bond, and extra liability coverage.

Calling all small business owners of Menlo Park!

This small business insurance is not risky

Small Business Insurance You Can Count On

Whether you own a tailoring service, a dry cleaner or a beauty salon, State Farm is here to help. Aside from remarkable service all around, you can customize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Call Emily Chapman today, and let's get down to business.

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Emily Chapman

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.